Content Menu

● 1. Sustainability-Driven Innovations

>> Eco-Friendly Material Integration

>> Waste Reduction Technologies

● 2. Smart Automation and IoT Integration

>> Real-Time Process Monitoring

>> AI-Driven Optimization

● 3. Plant-Based and Alternative Protein Focus

>> High-Moisture Extrusion for Meat Analogs

>> Customizable Protein Textures

● 4. Advanced Extruder Designs

>> Twin-Screw Dominance

>> All-in-One Forming Systems

● 5. Globalization and Flavor Diversification

>> Regional Flavor Adaptation

>> Co-Extrusion for Layered Products

● 6. Nutritional Enhancement and Functional Foods

>> Nutrient Retention Techniques

>> Dietary Fiber Incorporation

● 7. Market Expansion and Key Players

>> Growth in Emerging Economies

>> Strategic Industry Collaborations

● 8. Synergy with Complementary Technologies

>> High-Pressure Processing (HPP) Integration

>> 3D Food Printing Convergence

● Conclusion

● FAQ

>> Q1: What is food extrusion machinery?

>> Q2: How does IoT enhance food extrusion?

>> Q3: Why are twin-screw extruders preferred?

>> Q4: What role does extrusion play in plant-based foods?

>> Q5: How does extrusion impact nutrition?

● Citations:

Food extrusion machinery has become a cornerstone of modern food processing, enabling the production of diverse products ranging from snacks to plant-based meat analogs. As consumer demands evolve and sustainability takes center stage, the industry is witnessing transformative advancements. Below, we explore the latest innovations shaping this dynamic field.

1. Sustainability-Driven Innovations

Eco-Friendly Material Integration

Manufacturers are prioritizing sustainable practices by incorporating plant-based proteins (e.g., legumes, algae) and reducing energy consumption. Twin-screw extruders now process alternative ingredients like insect protein, which require fewer resources than traditional livestock farming. For instance, companies are utilizing agricultural byproducts such as rice bran and spent grains to create nutrient-dense extruded snacks, reducing landfill waste by 15%[1][7].

Waste Reduction Technologies

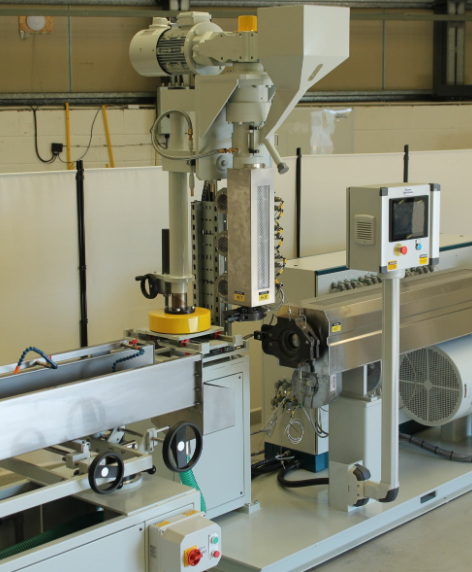

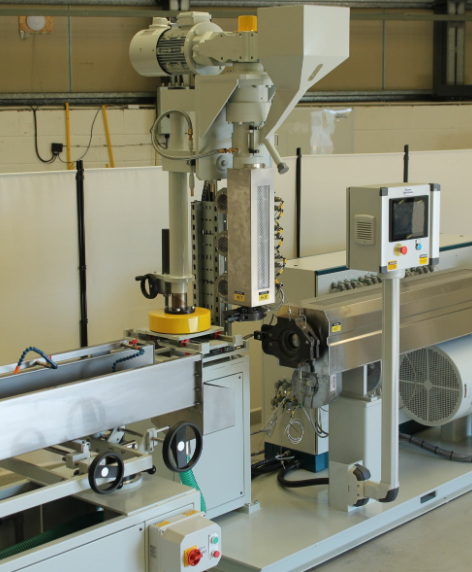

Advanced extrusion systems minimize waste through precise control of moisture and temperature. Modular extruder designs allow quick reconfiguration for different recipes, reducing raw material waste during product transitions. The FS 525 all-in-one system by Handtmann Inc. exemplifies this trend, integrating shaping, cutting, and molding into a single unit to streamline production and reduce energy use by 20%[1][8].

2. Smart Automation and IoT Integration

Real-Time Process Monitoring

IoT-enabled sensors in food extrusion machinery collect data on temperature, pressure, and viscosity, enabling instant adjustments for consistent quality. Predictive maintenance algorithms reduce downtime by up to 30% by identifying potential equipment failures early. For example, AI-driven platforms analyze historical data to optimize screw speed and barrel temperature, ensuring uniform texture in products like breakfast cereals[5][6].

AI-Driven Optimization

Machine learning models are now used to simulate extrusion processes, reducing trial-and-error R&D cycles by 40%. These systems predict outcomes for novel ingredients, such as mycoprotein blends, accelerating the development of sustainable meat alternatives[3][6].

3. Plant-Based and Alternative Protein Focus

High-Moisture Extrusion for Meat Analogs

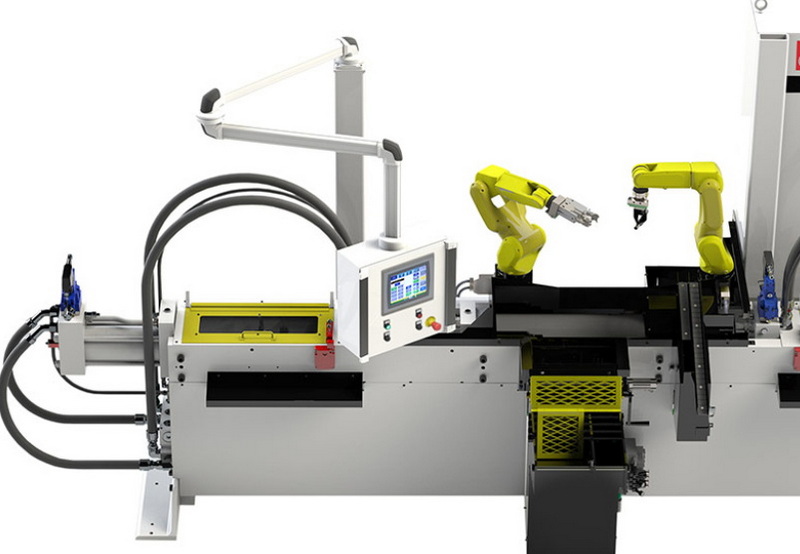

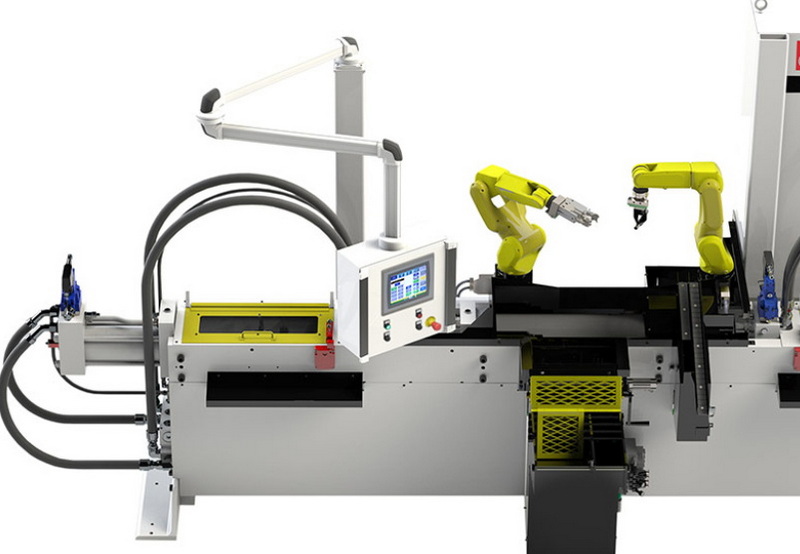

Twin-screw extruders with specialized dies create fibrous textures that mimic animal meat. Companies like Handtmann Inc. have introduced co-extrusion systems for producing vegetable-filled meatballs, catering to vegan and flexitarian markets. Recent breakthroughs include extruders capable of layering pea protein with beetroot-derived heme to replicate the juiciness of beef patties[1][3].

Customizable Protein Textures

Adjustable shear forces in modern extruders allow manufacturers to tailor the mouthfeel of plant-based products. For instance, low-shear configurations produce tender "pulled pork" textures, while high-shear settings create firm nugget structures. This flexibility supports the creation of everything from chewy jerky to delicate seafood analogs[7][8].

4. Advanced Extruder Designs

Twin-Screw Dominance

Twin-screw extruders dominate the market due to superior mixing and energy efficiency. Their segmented screws and modular barrels enable customization for specific applications, such as gluten-free snacks or pet food. Contra-twin screw models are gaining traction for heat-sensitive ingredients like probiotics, achieving 98% microbial survival rates during processing[4][8].

All-in-One Forming Systems

Machines like the FS 525 combine shaping, cutting, and molding into a single unit. This innovation streamlines production of filled snacks and 3D-shaped products, reducing labor costs by 25% and enhancing scalability. A notable application includes co-extruded cereal bars with dual-texture cores, such as crunchy exteriors with chewy fruit centers[1][7].

5. Globalization and Flavor Diversification

Regional Flavor Adaptation

Extrusion machinery now accommodates spices and ingredients from diverse cuisines. For example, extruders produce Latin American-inspired chili snacks using native maize varieties and Asian-flavored textured vegetable proteins (TVP) infused with lemongrass and galangal. This trend aligns with the globalization of consumer palates, driving a 12% annual growth in ethnic snack sales[3][7].

Co-Extrusion for Layered Products

Multi-layered snacks and confectionery items are achievable through co-extrusion dies. This technology enables precise encapsulation of fillings, such as fruit pastes or cheese, within a crispy outer shell. Recent innovations include triple-layer pet food kibble with differentiated nutritional zones (protein-rich core, vitamin-coated shell)[8].

6. Nutritional Enhancement and Functional Foods

Nutrient Retention Techniques

HTST (High-Temperature Short-Time) extrusion preserves heat-sensitive vitamins and antioxidants. This is critical for functional foods like fortified cereals and probiotic-enriched snacks. For example, extruded quinoa-based baby food retains 90% of its native iron content, addressing global malnutrition concerns[4][7].

Dietary Fiber Incorporation

Extruders efficiently blend soluble fibers (e.g., inulin) into products without compromising texture. A breakthrough involves using citrus peel waste as a fiber source, creating low-calorie crispbreads with 30% higher fiber content than traditional versions[3][6].

7. Market Expansion and Key Players

Growth in Emerging Economies

Countries like India and Brazil are adopting extrusion technology for affordable, shelf-stable staples. Localized machines handle indigenous grains like sorghum and millet, supporting regional food security. India's processed food exports surged to $21.5 billion in 2022, driven by extruded ready-to-eat meals[1][7].

Strategic Industry Collaborations

Major players like Brabender and Marel are partnering to integrate extrusion with downstream processes (e.g., packaging). These collaborations accelerate R&D in plant-based and aquafeed sectors. For instance, Brabender's recent alliance with a biotech firm aims to develop algae-based extruded proteins for aquaculture[4][8].

8. Synergy with Complementary Technologies

High-Pressure Processing (HPP) Integration

Post-extrusion HPP treatment extends shelf life by 50% while preserving nutrients in plant-based meats. This combination allows brands to eliminate synthetic preservatives in products like vegan deli slices[2][3].

3D Food Printing Convergence

Hybrid systems now combine extrusion with 3D printing to create geometrically complex snacks. A notable example is personalized nutrition bars with lattice structures optimized for controlled nutrient release[6].

Conclusion

The food extrusion machinery sector is rapidly evolving, driven by sustainability, automation, and consumer-centric innovation. From smart IoT systems to plant-based protein texturization, these advancements are redefining food production. The global market, projected to reach $137.95 billion by 2029 at a 9% CAGR, demands continuous adaptation to trends like precision fermentation and circular economy practices[1][7]. Manufacturers must prioritize flexibility, eco-efficiency, and cross-industry collaborations to maintain competitiveness in this dynamic landscape.

FAQ

Q1: What is food extrusion machinery?

Food extrusion machinery processes raw ingredients into shaped, textured products through mechanical force and heat. It's used for snacks, cereals, and meat analogs[1][4].

Q2: How does IoT enhance food extrusion?

IoT enables real-time monitoring of parameters like temperature and pressure, improving consistency and reducing waste through predictive maintenance[5][6].

Q3: Why are twin-screw extruders preferred?

They offer superior mixing, energy efficiency, and versatility for diverse products, from gluten-free pasta to textured plant proteins[4][8].

Q4: What role does extrusion play in plant-based foods?

Extrusion creates meat-like textures using plant proteins and enables co-extrusion for filled products like vegan cheese snacks[1][3].

Q5: How does extrusion impact nutrition?

HTST extrusion retains nutrients while enhancing digestibility. It also allows fortification with vitamins and dietary fibers[3][7].

Citations:

[1] https://www.openpr.com/news/3908249/key-trend-reshaping-the-food-extrusion-market-in-2025-major

[2] https://www.hiperbaric.com/en/2025-emerging-perspectives-and-trends-in-high-pressure-processing-hpp/

[3] https://www.ift.org/news-and-publications/food-technology-magazine/issues/2024/november/features/outlook-2025-technology-trends

[4] https://pmarketresearch.com/product/worldwide-cannabis-packaging-machine-market-research-2024-by-type-application-participants-and-countries-forecast-to-2030/worldwide-food-extrusion-machine-market-research-2024-by-type-application-participants-and-countries-forecast-to-2030

[5] https://foodindustryexecutive.com/2024/11/2025-food-industry-tech-trends-ai-and-supply-chain-solutions-lead-investment-priorities/

[6] https://www.fjdynamics.com/blog/industry-insights-65/new-agriculture-technology-342

[7] https://www.globalgrowthinsights.com/market-reports/food-extrusion-market-108007

[8] https://www.newschannelnebraska.com/story/52565942/pet-food-extrusion-machines-market-trends-reshaping-the-industry-from-2025-to-2033-report-of-114-pages