Content Menu

● Introduction to HDPE Sheet Line Extrusion Technology

● Current Trends Reshaping HDPE Sheet Extrusion

>> 1. Automation and Precision Control

>> 2. Recycled Material Integration

>> 3. Energy Efficiency

>> 4. High-Output Configurations

● Emerging Technologies Driving the Next Decade

>> 1. Industry 4.0 and Smart Factories

>> 2. Advanced Material Engineering

>> 3. Sustainable Manufacturing

>> 4. Integrated Downstream Processes

● Challenges Facing HDPE Extrusion Factories

● Growth Opportunities

>> 1. Customized Sheet Solutions

>> 2. Emerging Markets

>> 3. Circular Economy Partnerships

>> 4. Lightweighting in Automotive

● Case Study: YeJing's Smart Extrusion Line

● Conclusion

● FAQ

>> 1. How do HDPE sheet lines handle recycled materials?

>> 2. What's the ROI for upgrading to Industry 4.0-compliant machinery?

>> 3. Which industries use the most HDPE sheets?

>> 4. Can HDPE sheets replace PVC in medical applications?

>> 5. What's the future of HDPE sheet pricing?

● Citations:

High-Density Polyethylene (HDPE) sheet line extrusion machinery factories are undergoing transformative changes driven by technological advancements, sustainability demands, and evolving industrial needs. This article explores the trajectory of these factories, focusing on innovations, challenges, and growth opportunities shaping their future.

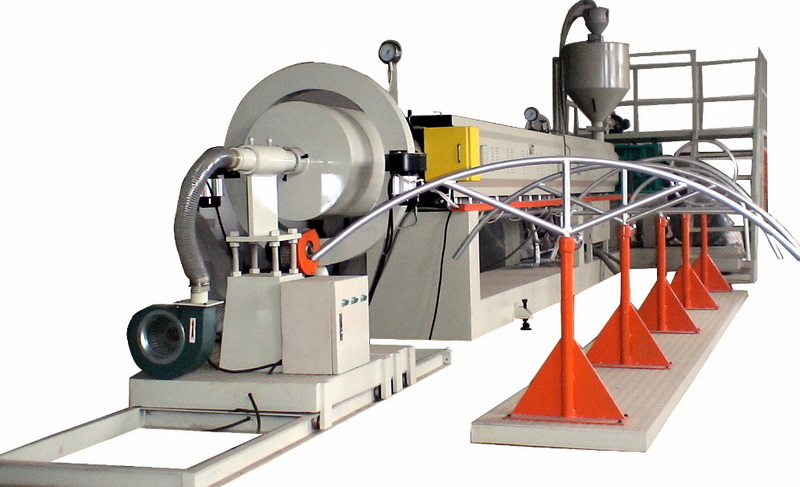

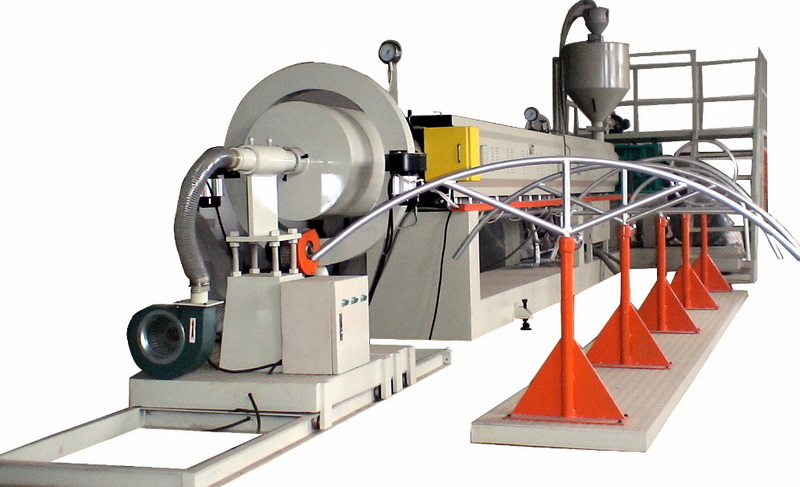

Introduction to HDPE Sheet Line Extrusion Technology

HDPE sheet extrusion involves converting raw HDPE pellets into durable, flexible sheets through a process of melting, shaping, cooling, and cutting. These sheets are widely used in construction (e.g., waterproof barriers), packaging (e.g., industrial containers), automotive (e.g., lightweight panels), and agriculture (e.g., greenhouse covers). The machinery's core components include:

- Extruder: Melts and homogenizes HDPE pellets (single or twin-screw designs).

- Flat Die: Shapes molten polymer into uniform sheets.

- Chill Rolls: Rapidly cool sheets to stabilize dimensions.

- Cutting/Winding Systems: Trim and prepare sheets for distribution.

Modern lines achieve production capacities up to 1,700 kg/hour with thickness tolerances as low as ±0.02 mm[4].

Current Trends Reshaping HDPE Sheet Extrusion

1. Automation and Precision Control

Advanced PLC systems now enable real-time adjustments to temperature, pressure, and speed, reducing human error. For example, inline thickness gauges automatically adjust die gaps to maintain consistency, while IoT-enabled sensors predict maintenance needs, cutting downtime by 30%[3][5].

2. Recycled Material Integration

Over 45% of factories now blend post-consumer HDPE with virgin material. Innovations like multi-stage filtration and decontamination extruders ensure recycled flakes meet quality standards without compromising sheet integrity[1][4].

3. Energy Efficiency

New extruders consume 15–20% less energy via features like:

- Variable-frequency drives (VFDs) for motors.

- Heat recovery systems that reuse waste energy.

- Optimized screw designs reducing friction[4][7].

4. High-Output Configurations

Tandem extrusion lines now combine multiple extruders feeding into a single die, boosting output to 2,500 kg/hour for large-scale projects like geomembrane production[7].

Emerging Technologies Driving the Next Decade

1. Industry 4.0 and Smart Factories

- Digital Twins: 3D simulations optimize parameters like melt temperature and cooling rates before production, reducing trial waste by 40%[1][5].

- AI-Powered Predictive Maintenance: Algorithms analyze vibration and thermal data to forecast component failures weeks in advance[3].

- Blockchain Traceability: Track recycled material sources and carbon footprints for ESG compliance[7].

2. Advanced Material Engineering

- Nano-Composite HDPE: Graphene-infused sheets offer 50% higher tensile strength for automotive applications.

- Multi-Layer Coextrusion: Combines HDPE with EVOH or nylon for enhanced UV/chemical resistance[1][5].

3. Sustainable Manufacturing

- Closed-Loop Recycling: On-site reprocessing of scrap material reduces waste to near-zero.

- Bio-Based HDPE: Pilot projects use sugarcane-derived ethylene to cut carbon emissions by 70%[7].

4. Integrated Downstream Processes

Machinery now combines extrusion with:

- Inline Printing: Directly apply logos or safety markings.

- Thermoforming: Convert sheets into finished products like trays or panels without secondary handling[5].

Challenges Facing HDPE Extrusion Factories

1. High Capital Costs: Upgrading to smart extruders and IoT systems requires investments exceeding $2M for mid-sized plants[3][4].

2. Regulatory Pressures: Stricter emissions laws (e.g., EPA guidelines) and recycled-content mandates (e.g., 30% by 2030 in the EU) demand rapid adaptation[3][7].

3. Resin Price Volatility: Geopolitical disruptions have caused HDPE pellet prices to fluctuate by ±25% annually since 2023[7].

4. Skill Gaps: Operating advanced lines requires technicians trained in AI analytics and mechatronics, creating recruitment challenges[5].

Growth Opportunities

1. Customized Sheet Solutions

Factories offering tailored properties (e.g., antistatic, flame-retardant) gain contracts in niche markets like electronics and aerospace.

2. Emerging Markets

Asia-Pacific's construction boom will drive 12% annual demand growth through 2030, with India and China leading[7].

3. Circular Economy Partnerships

Collaborating with waste management firms ensures steady recycled feedstock. For example, Veolia now supplies 10,000+ tons/year of certified post-consumer HDPE to sheet producers[1].

4. Lightweighting in Automotive

EV manufacturers seek HDPE sheets to replace metal parts, reducing vehicle weight by 20% and improving battery range[4].

Case Study: YeJing's Smart Extrusion Line

YeJing's AI-Optimized HDPE Line (2024) integrates:

- Self-Learning Extruders: Adjust screw speed based on resin moisture levels.

- Automated Defect Detection: Cameras flag inconsistencies at 120 frames/second.

- Energy Recovery: 85% of waste heat reused, cutting energy costs by $18,000/year[4][5].

Conclusion

The future of HDPE sheet line extrusion machinery factories hinges on balancing automation, sustainability, and customization. While challenges like high-tech costs and regulatory hurdles persist, innovations in AI, material science, and circular manufacturing will drive long-term growth. Factories that adopt agile strategies and invest in R&D will lead the transition to smarter, greener production.

FAQ

1. How do HDPE sheet lines handle recycled materials?

Modern lines use multi-stage filtration and devolatilization extruders to remove impurities from post-consumer HDPE, allowing up to 50% recycled content without sacrificing sheet quality[1][4].

2. What's the ROI for upgrading to Industry 4.0-compliant machinery?

Plants report 18–24 month payback periods via 30% higher uptime and 22% lower energy use[3][5].

3. Which industries use the most HDPE sheets?

- Construction (35%): Waterproofing membranes, damp-proof courses.

- Packaging (28%): Food-grade containers, pharmaceutical packaging.

- Agriculture (20%): Greenhouse covers, pond liners[2][7].

4. Can HDPE sheets replace PVC in medical applications?

Yes—new antibacterial HDPE formulations meet ISO 10993 standards for surgical trays and device housings[2][4].

5. What's the future of HDPE sheet pricing?

Prices will stabilize as recycling infrastructure expands, with bio-based HDPE costing $1.10–$1.30/lb by 2030 vs. $0.90/lb for conventional grades[7].

Citations:

[1] https://jieyatwinscrew.com/blog/hdpe-pipe-extrusion-line/

[2] https://www.singhalglobal.com/blog/unveiling-the-power-of-hdpe-sheets-in-modern-manufacturing

[3] https://www.globenewswire.com/news-release/2025/01/02/3003332/0/en/U-S-Plastic-Extrusion-Machine-Market-to-Hit-Valuation-of-US-1-548-99-Million-By-2033-Rapid-Innovation-and-Growing-Collaboration-Fueling-Market-Growth-Says-Astute-Analytica.html

[4] https://www.yjing-extrusion.com/how-to-find-affordable-hdpe-sheet-line-extrusion-machinery-for-your-business.html

[5] https://www.plasticsmachinerymanufacturing.com/extrusion/article/21161172/oems-forecast-high-tech-future-for-extrusion

[6] https://blog.hdpeweldingmachine.com/2025-hdpe-sheet-welding-machines/

[7] https://github.com/laverkyllozc/Market-Research-Report-List-1/blob/main/hdpe-extrusion-line-market.md

[8] https://www.bausano.com/en

[9] https://www.datainsightsmarket.com/reports/plastic-extrusion-sheet-production-line-41821

[10] https://nancy-rubin.com/2024/04/22/unveiling-the-power-of-hdpe-sheets-usage-and-future-trends/

[11] https://bogdamachine.en.made-in-china.com/product-group/ebqAfnEJmPWY/Sheet-Extrusion-Line-catalog-1.html

[12] https://www.thebusinessresearchcompany.com/report/extrusion-sheet-global-market-report

[13] https://hunterplastics.com/trends-in-plastic-extrusion-technology

[14] https://www.benkpm.com/hdpe-sheets/

[15] https://pmarketresearch.com/product/worldwide-compact-turbo-compressor-market-research-2024-by-type-application-participants-and-countries-forecast-to-2030/worldwide-hdpe-extrusion-line-market-research-2024-by-type-application-participants-and-countries-forecast-to-2030

[16] https://www.forinsightsconsultancy.com/reports/high-density-polyethylene-hdpe-market/

[17] https://social.rajoo.com/were-setting-the-stage-for-innovation-at-plast-imagen-2025-visit-us-at-stand-no-2224-from-march-1114-in-1899789680293593308

[18] https://www.plasticsmachinerymanufacturing.com/manufacturing/article/55250477/will-the-plastics-machinery-market-rebound-in-2025

[19] https://www.globenewswire.com/news-release/2025/02/05/3021359/0/en/Plastic-Extrusion-Machine-Market-to-Grow-at-4-7-CAGR-During-2025-2035-Boosting-Global-Industry-to-USD-12-343-2-Million-by-2035-Future-Market-Insights-Inc.html

[20] https://www.ifanpiping.com/info/hdpe-pipe-fittings-future-development-trends-96104052.html