Content Menu

● 1. Market Overview

● 2. Technological Innovations

● 3. Environmental Considerations

● 4. Applications Across Industries

>> Automotive Industry

>> Construction Sector

>> Electronics

>> Aerospace

>> Healthcare

● 5. Key Players in Ontario's Aluminum Extrusion Market

● 6. Challenges Facing the Industry

● 7. Product Innovations and Market Trends

● 8. Regional Analysis

● 9. The Impact of AI

● Conclusion

● FAQ

>> 1. What are the main benefits of using aluminum extrusions?

>> 2. How does automation impact aluminum extrusion processes?

>> 3. What industries primarily utilize aluminum extrusions?

>> 4. Are there any environmental benefits associated with aluminum recycling?

>> 5. What challenges does the aluminum extrusion industry face?

● Citations:

The aluminum extrusion industry in Ontario is experiencing significant growth and transformation, driven by various factors including technological advancements, environmental concerns, and the increasing demand for lightweight materials across multiple sectors. This article explores the latest trends in aluminum extrusion in Ontario, highlighting market dynamics, technological innovations, and applications across industries.

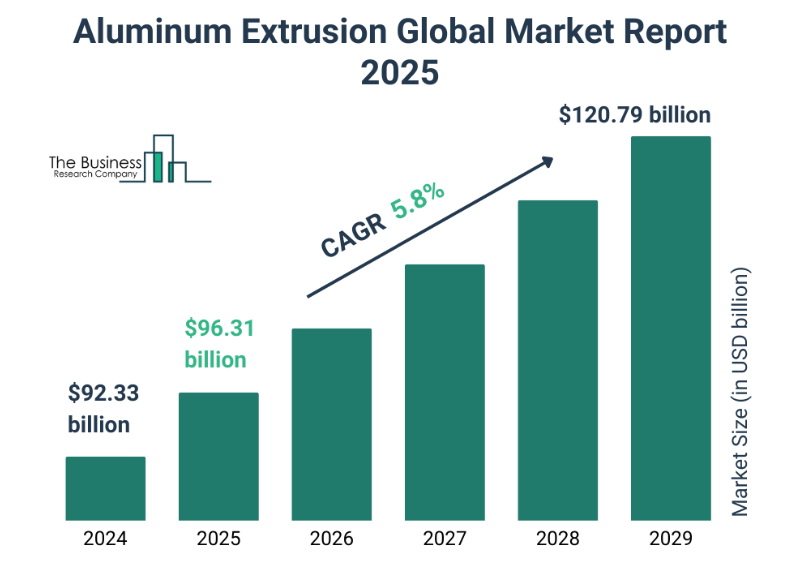

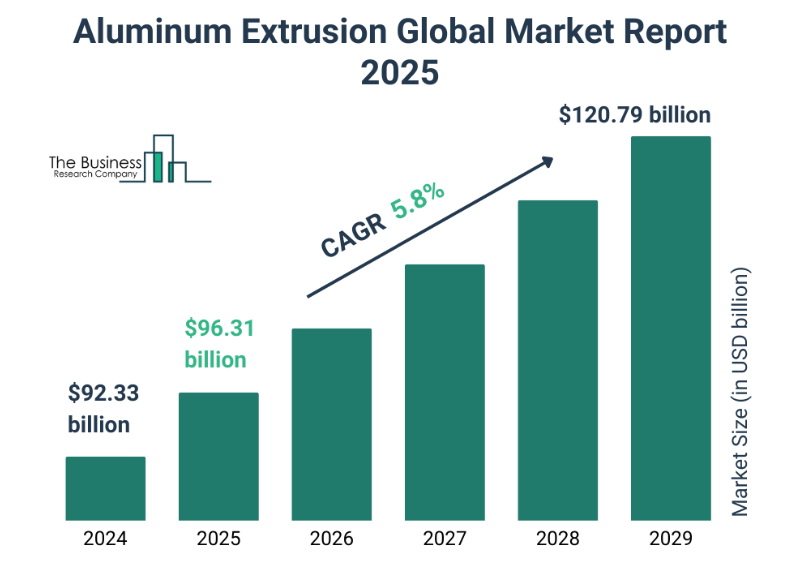

1. Market Overview

The aluminum extrusion market in Ontario is a vital segment of the broader North American aluminum industry. The North America aluminum extrusion market was valued at USD 9.45 billion in 2023, and is expected to reach around USD 18.56 billion by 2033, expanding at a CAGR of 7.12% from 2024 to 2033[1][7]. The Canadian aluminum extrusion market reached USD 6.63 billion in 2023 and is projected to attain around USD 13.16 billion by 2033, reflecting a compound annual growth rate (CAGR) of 7.22% from 2024 to 2033[1]. This growth is largely attributed to:

- Increased Demand in Automotive and Transportation: The automotive sector is a major consumer of aluminum extrusions due to the material's lightweight properties and strength, which contribute to fuel efficiency and performance[3][5]. The push toward fuel-efficient vehicles is bolstering the sales of aluminum extrusion solutions in the automotive industry, where they're used in heat exchangers and structural components[3]. Aluminum use is predicted to increase to 556 pounds per vehicle by 2030[3]. Battery electric light trucks may average 644 pounds of aluminum[3].

- Infrastructure Development: Ongoing investments in infrastructure projects across Ontario are driving demand for aluminum products in construction and building applications[1]. The increasing demand for residential and commercial structures is boosting the building and construction segment, with the sector poised to capture a revenue share of over 56.8% by 2037[3].

- Sustainability Initiatives: The push towards sustainable manufacturing practices has led to an increased focus on recycling and the use of eco-friendly materials[5]. The emission goals and fuel economy trends are backing the trade of extruded aluminum[3]. The EV trend and investments in green building structures are also contributing[3].

2. Technological Innovations

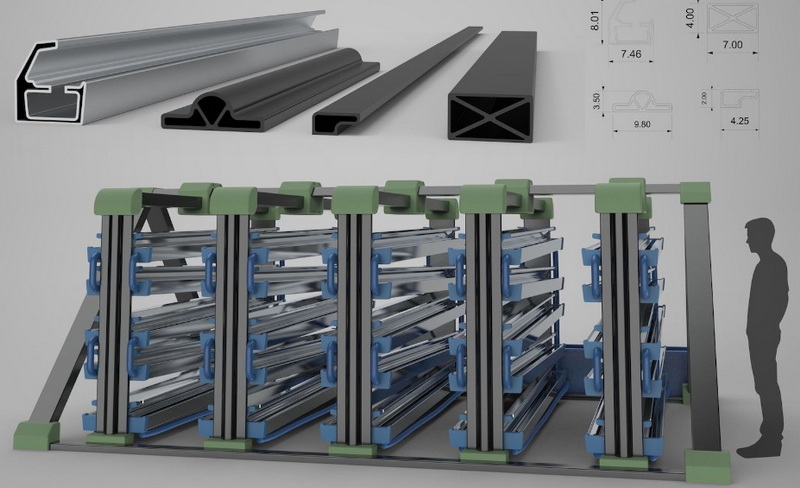

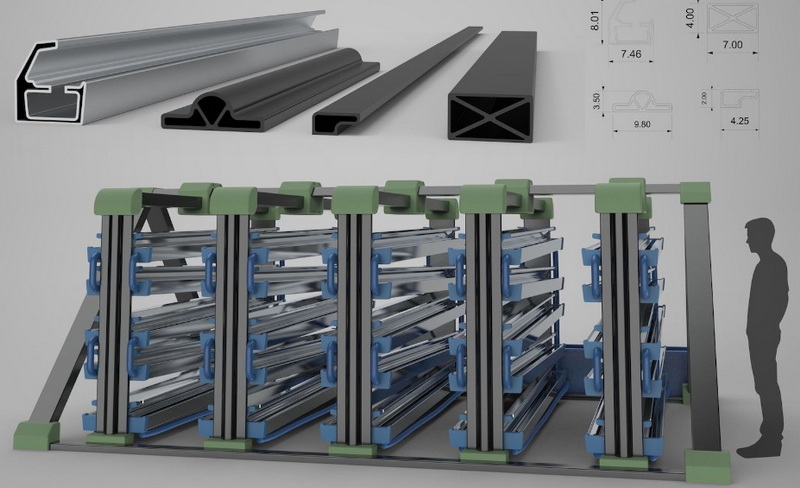

Recent technological advancements are reshaping the aluminum extrusion landscape in Ontario. Key innovations include:

- Automation and Robotics: Many manufacturers are integrating automation into their extrusion processes[5]. Automated systems enhance efficiency, reduce labor costs, and improve precision in production[5]. Today's extrusion lines use robotics, AI, and IoT to streamline processes and maximize efficiency[5]. AI-driven systems offer real-time feedback, automatically adjusting parameters to maintain consistency, while robotics handles material transport with precision[5].

- Advanced Alloys: Newer aluminum alloys with enhanced strength and corrosion resistance are being developed, allowing for more demanding applications in industries like aerospace and automotive[5]. The development of specialized aluminum alloys has expanded the potential of extrusion technology, offering enhanced strength, temperature tolerance and corrosion resistance[5].

- AI and IoT Integration: The use of artificial intelligence (AI) and the Internet of Things (IoT) is becoming prevalent in monitoring production processes[2][5][7]. These technologies enable real-time adjustments to improve quality control and reduce waste[2]. AI integration has the potential to optimize the extrusion process, reduce waste, enhance product quality, identify errors, minimize manual inspection, and offer precision control[2].

3. Environmental Considerations

Sustainability is a critical focus for the aluminum extrusion industry. The following trends highlight this commitment:

- Recycling Practices: Aluminum is highly recyclable, retaining its properties throughout the recycling process[3][5]. This characteristic significantly reduces energy consumption compared to primary aluminum production[5]. The aluminum scrap trade is influencing revenues, with the U.S. Geological Survey (USGS) reporting that 3.3 million tons of aluminum were recovered from purchased scrap[3].

- Green Manufacturing Initiatives: Companies are adopting green processes to minimize their environmental impact[5]. This includes using renewable energy sources for production and implementing waste reduction strategies[5]. Modern extrusion presses consume less energy and generate lower emissions, aligning with global environmental standards[5]. Closed-loop recycling systems reduce waste by reclaiming and reusing aluminum[5].

4. Applications Across Industries

Aluminum extrusions are utilized in various sectors within Ontario, including:

Automotive Industry

The automotive sector remains one of the largest consumers of aluminum extrusions[3][5]. With the rise of electric vehicles (EVs), manufacturers are increasingly using aluminum for components such as structural frames and battery housings due to its lightweight nature and recyclability[3][5]. Aluminum extrusions find wide application in heat exchangers, structural components, and various parts of vehicles[3].

Construction Sector

In construction, aluminum extrusions are favored for their durability and aesthetic appeal[1]. They are commonly used in window frames, curtain walls, and roofing systems[1]. The increasing demand for residential and commercial structures is expected to boost the building and construction segment[3].

Electronics

The electronics industry is leveraging aluminum extrusions for heat sinks, enclosures, and other components due to their excellent thermal conductivity[3]. Extruded aluminum is finding emerging applications in electrical and electronics, including photovoltaic panel support structures, picture frames, display cabinets, and point-of-sale displays[3].

Aerospace

The aerospace sector is anticipated to substantially boost aluminum extrusion sales due to the demand for innovative and lightweight materials[3]. Aluminum extrusions are used in aircraft, helicopters, and military vehicles to replace heavier materials[3]. Aluminum alloys represent nearly 40% of the U.S. aerospace material market[3].

Healthcare

Aluminum extrusion is used in healthcare applications like patient care, manufacturing beds, equipment stands, patient positioning systems, cubicle curtain tracks, corridor crash/handrails, service panels and electrical/utility raceways, and surgical lights[1]. The increasing healthcare sector and demand for advanced diagnostic machines are contributing to market growth[1].

5. Key Players in Ontario's Aluminum Extrusion Market

Several companies dominate the aluminum extrusion landscape in Ontario:

- Dajcor Aluminum: A leading supplier known for its extensive range of extruded products serving various industries including automotive and renewable energy.

- Can Art Aluminum Extrusion: Specializes in producing parts for electric vehicles, contributing to Ontario's growing EV sector.

- Extrude-A-Trim: Offers a wide variety of specialty extruded products with quick turnaround times.

6. Challenges Facing the Industry

Despite its growth prospects, the aluminum extrusion industry faces challenges such as:

- High Initial Costs: The capital-intensive nature of setting up extrusion facilities can deter new entrants into the market[1][3]. The increasing initial cost of aluminum extrusion in manufacturing industries restricts market growth[1]. Aluminum extrusion is a costly and energy-intensive process, requiring significant investment in manufacturing infrastructure[3].

- Intense Competition: Existing players dominate the market, making it difficult for newcomers to establish themselves without significant investment or innovation[3]. Intense competition can lower revenue growth, with both domestic and international market players vying for market share[3]. Strong competition leads to pressure on profitability[3].

7. Product Innovations and Market Trends

Aluminum extrusion companies are focusing on product innovations and developing new product solutions to strengthen their position in the market[6]. For example, new aluminum train wagons are made from high-strength aluminum alloy plates and extrusions[6]. These wagons are lighter, consume less energy, are corrosion-resistant, and are recyclable[6].

Customized lightweight shapes is a major trend, driven by new design considerations and product shrinking[7]. Growing distribution centers in North America are also driving the need for extrusions[7]. New alloy development is another trend, with enhanced properties like corrosion resistance and strength[7].

8. Regional Analysis

The North America aluminum extrusion market includes the United States, Canada, and Mexico[1]. Canada dominated the North America aluminum extrusion market with the largest revenue share of 70.2% in 2023[1]. The increasing infrastructural development and rising industrialization are driving demand for aluminum extrusion activities in Canada[1]. The national Aluminum Manufacturing industry is most heavily concentrated in Ontario, Quebec, and British Columbia[4].

9. The Impact of AI

The integration of Artificial Intelligence (AI) is significantly impacting the North America Aluminum Extrusion Market, driving advancements across manufacturing, design, supply chain management, and sustainability[7]. Industries like construction, automotive, and aerospace increasingly rely on aluminum extrusions for their lightweight and versatile properties, AI is enabling manufacturers to meet these demands with greater efficiency and precision[7]. AI empowers manufacturers to improve efficiency, reduce costs, and innovate faster while maintaining high standards of quality and sustainability[7].

Conclusion

The aluminum extrusion industry in Ontario is poised for continued growth driven by technological advancements, sustainability initiatives, and increasing demand from various sectors such as automotive and construction[5]. As manufacturers adapt to changing market dynamics and consumer preferences, they will need to embrace innovation while addressing challenges related to costs and competition[5]. The industry's focus on sustainability, combined with the versatility and performance benefits of aluminum, positions it well for future success[5].

FAQ

1. What are the main benefits of using aluminum extrusions?

Aluminum extrusions offer several benefits including lightweight properties, high strength-to-weight ratio, corrosion resistance, design flexibility, and recyclability[5].

2. How does automation impact aluminum extrusion processes?

Automation enhances efficiency by reducing labor costs, minimizing human error, and improving production speed while maintaining high-quality standards[5].

3. What industries primarily utilize aluminum extrusions?

Key industries include automotive, construction, electronics, aerospace, renewable energy, and consumer goods manufacturing[3][5].

4. Are there any environmental benefits associated with aluminum recycling?

Yes, recycling aluminum requires significantly less energy compared to primary production processes; it uses only about 5% of the energy needed to create new aluminum from ore[5].

5. What challenges does the aluminum extrusion industry face?

Challenges include high initial setup costs for manufacturing facilities, intense competition among established players, and fluctuating raw material prices[1][3].

Citations:

[1] https://www.precedenceresearch.com/north-america-aluminum-extrusion-market

[2] https://www.precedenceresearch.com/aluminum-extrusion-market

[3] https://www.researchnester.com/reports/aluminum-extrusion-market/7191

[4] https://www.ibisworld.com/ca/industry/ontario/aluminum-manufacturing/14556/

[5] https://nationalindustries.world/2025/01/02/the-future-of-aluminum-how-extrusion-technology-is-transforming-industries/

[6] https://www.thebusinessresearchcompany.com/report/aluminum-extrusion-global-market-report

[7] https://www.globenewswire.com/news-release/2024/11/21/2985360/0/en/North-America-Aluminum-Extrusion-Market-Size-to-Surpass-USD-18-56-Bn-by-2033.html

[8] https://www.shengxinglobal.com/blog/aluminum-extrusion-profiles-the-definitive-guide-2025.html

[9] https://www.contestwatchers.com/2025-aluminum-extrusion-student-design-competition/

[10] https://www.huunglobal.com/join-us-at-bau-2025-discover-innovation/

[11] https://www.grandviewresearch.com/horizon/outlook/aluminum-extrusion-market/canada

[12] https://aec.org/design-competition

[13] https://www.6wresearch.com/industry-report/canada-aluminum-extrusion-market

[14] https://www.giiresearch.com/report/tbrc1658772-aluminum-extruded-products-global-market-report.html

[15] https://www.technavio.com/report/aluminum-extrusion-market-industry-analysis

[16] https://www.facebook.com/AlExtDesignCompetition/posts/calling-all-innovators-the-aec-design-competition-is-now-open-this-is-your-chanc/971460235014179/

[17] https://www.lightmetalage.com/news/industry-news/extrusion/aec-issues-call-for-entries-for-2025-aluminum-extrusion-design-competition/

[18] https://www.businesswire.com/news/home/20241003053405/en/AEC-Releases-Call-for-Entries-for-2025-Student-Aluminum-Extrusion-Design-Competition

[19] https://www.researchandmarkets.com/reports/5685568/2025-aluminium-extrusion-market-outlook-report

[20] https://www.alcircle.com/news/global-aluminium-industry-outlook-2025-whats-ahead-and-why-it-matters-113194