Content Menu

● Understanding Aluminum Extrusions and Antidumping Tariffs

● The Impact of Tariffs on Manufacturing Costs

● Broader Economic Implications

● Case Studies: Industries Affected by Tariffs

● Navigating the Challenges

● Future Outlook

● Conclusion

● FAQs

>> 1. What are antidumping tariffs?

>> 2. How do these tariffs impact manufacturing costs?

>> 3. Which industries are most affected by aluminum extrusion tariffs?

>> 4. What strategies can manufacturers employ to mitigate tariff impacts?

>> 5. Will these tariffs lead to higher consumer prices?

The aluminum extrusion industry is facing significant challenges due to recent antidumping tariffs imposed by the U.S. government. These tariffs are designed to protect domestic manufacturers from unfair competition posed by foreign producers selling aluminum extrusions at below-market prices. However, the implications of these tariffs are profound, affecting not only the cost structures of manufacturers but also the broader economy. This article explores how these antidumping tariffs are impacting manufacturers, the rationale behind their implementation, and the potential consequences for consumers and industries reliant on aluminum extrusions.

Understanding Aluminum Extrusions and Antidumping Tariffs

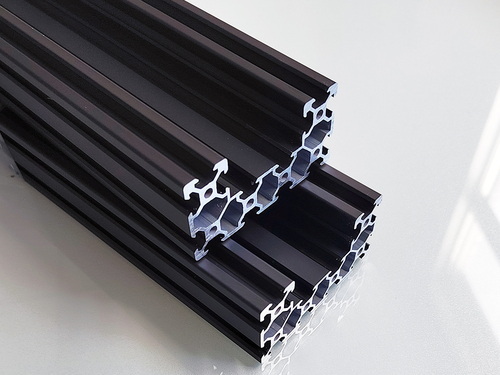

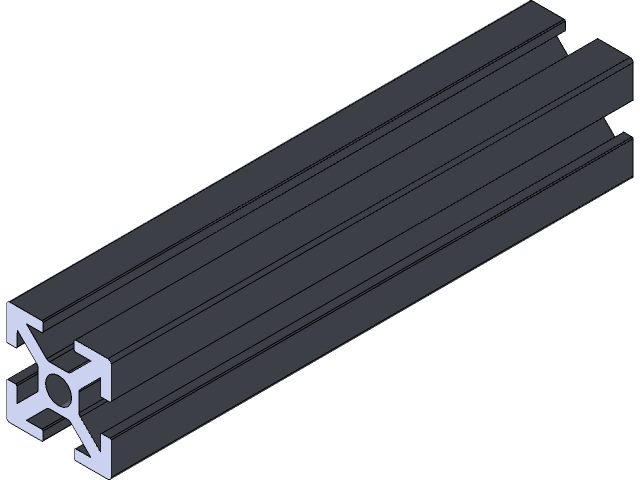

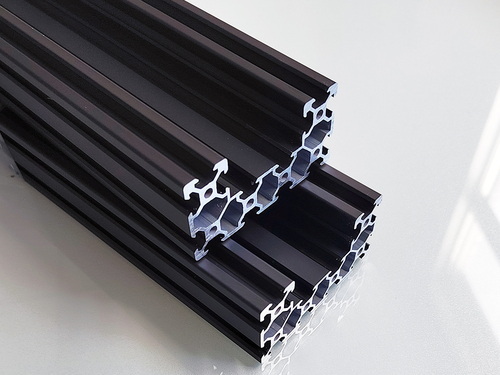

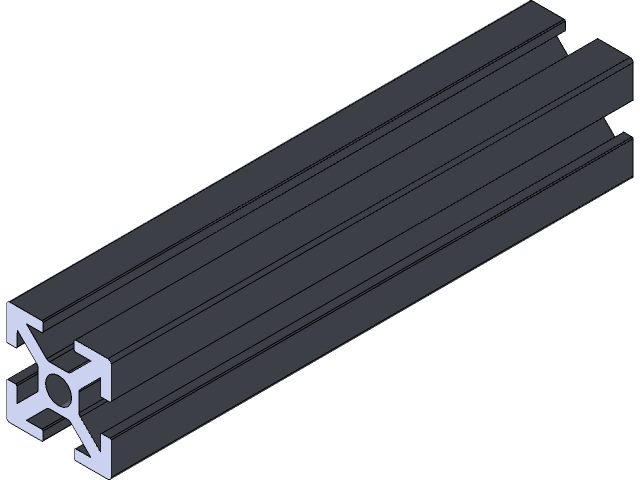

What are Aluminum Extrusions?

Aluminum extrusions are products created by forcing aluminum alloy through a die to create specific shapes. These shapes are used in various applications, including construction, automotive parts, and consumer goods. The versatility and lightweight nature of aluminum make it a preferred choice across many industries.

What Are Antidumping Tariffs?

Antidumping tariffs are duties imposed on foreign imports that are believed to be priced below fair market value. The U.S. Department of Commerce investigates these practices to determine if foreign producers are engaging in "dumping," which can harm domestic industries by undercutting prices.

In October 2023, the U.S. Department of Commerce initiated investigations into aluminum extrusions from 15 countries, including China, Mexico, and Turkey, following petitions from domestic manufacturers claiming injury from unfair pricing practices. The preliminary findings revealed dumping margins ranging from 2% to as high as 376% for certain exporters.

The Impact of Tariffs on Manufacturing Costs

The introduction of antidumping tariffs has led to a significant increase in costs for manufacturers relying on imported aluminum extrusions. Here's how:

- Increased Material Costs: With tariffs ranging from 1.45% to 169.66%, manufacturers who import aluminum extrusions face higher material costs. This increase can lead to a rise in production costs, which may be passed on to consumers through higher prices.

- Supply Chain Disruptions: Many manufacturers have relied on a global supply chain for their materials. The imposition of these tariffs disrupts established supply chains and can lead to delays in production as companies scramble to find alternative sources or adjust their procurement strategies.

- Shift Towards Domestic Suppliers: To mitigate tariff impacts, some manufacturers are turning towards domestic suppliers. While this may help avoid tariffs, it can also lead to higher prices if domestic suppliers do not have the same economies of scale as their foreign counterparts.

- Increased Operational Complexity: Navigating the complexities of compliance with tariff regulations adds another layer of operational challenges for manufacturers. Companies must invest time and resources into understanding tariff classifications and ensuring compliance with regulations, which can divert focus from core business activities.

Broader Economic Implications

The ramifications of these antidumping tariffs extend beyond just individual manufacturers:

- Consumer Prices: As manufacturers face increased costs due to tariffs, they often pass these costs onto consumers. This can lead to higher prices for products that utilize aluminum extrusions, affecting everything from construction materials to consumer electronics.

- Industry Competitiveness: While the intent of the tariffs is to protect domestic producers, there is a risk that they may inadvertently harm competitiveness in industries that rely heavily on aluminum extrusions. Higher costs could stifle innovation and growth in sectors such as construction and automotive manufacturing.

- Job Market Effects: The shift towards domestic sourcing may create jobs in local manufacturing but could also lead to job losses in companies that cannot compete with higher domestic prices or those that rely on imported materials for their production processes.

- Global Trade Relations: The imposition of antidumping tariffs can strain trade relations between the U.S. and exporting countries. Countries affected by these tariffs may retaliate with their own trade measures, leading to a cycle of escalating tariffs that can disrupt global supply chains further.

Case Studies: Industries Affected by Tariffs

Several industries are particularly vulnerable to the impacts of aluminum extrusion antidumping tariffs:

- Construction Industry: The construction sector relies heavily on aluminum for windows, doors, and structural components. Increased costs due to tariffs can raise overall construction expenses, potentially slowing down new projects and renovations.

- Automotive Sector: Aluminum is a key material in vehicle manufacturing for parts like frames and body panels. Higher material costs could lead to increased vehicle prices, affecting consumer purchasing behavior.

- Consumer Goods: Products such as furniture and appliances often use aluminum components. As manufacturers face higher costs, consumers may see price increases across a wide range of everyday goods.

- Aerospace Industry: The aerospace sector utilizes aluminum extrusions extensively due to their lightweight properties and strength-to-weight ratio. Increased costs could impact the pricing of aircraft components and ultimately affect ticket prices for consumers.

Navigating the Challenges

Manufacturers facing challenges due to antidumping tariffs have several strategies they can employ:

- Diversifying Supply Chains: Companies can explore alternative suppliers from countries not affected by tariffs or invest in domestic production capabilities. This diversification helps mitigate risks associated with reliance on specific suppliers or regions.

- Investing in Technology: Automation and improved manufacturing processes can help reduce costs and offset some of the financial burdens imposed by increased material prices. Embracing advanced technologies like robotics or AI-driven solutions can enhance efficiency and productivity.

- Advocacy and Policy Engagement: Engaging with industry associations and policymakers can help influence future trade policies and potentially lead to tariff exemptions or reductions for certain products.

- Cost Management Strategies: Manufacturers might implement cost management strategies such as lean manufacturing principles or just-in-time inventory systems to reduce waste and improve cash flow amidst rising material costs.

Future Outlook

The future landscape for aluminum extrusion manufacturers remains uncertain as global economic conditions evolve. Factors such as fluctuating demand for aluminum products, changes in trade policies, and advancements in manufacturing technologies will play critical roles in shaping this industry.

- Sustainability Trends: There is an increasing emphasis on sustainability within manufacturing processes. Companies that adopt eco-friendly practices may find new market opportunities despite rising costs associated with tariffs.

- Innovation in Materials: Research into alternative materials or advanced composites could provide solutions for industries reliant on aluminum extrusions while mitigating cost increases due to tariffs.

- Potential Policy Changes: As economic conditions shift, there may be calls for reevaluating existing tariffs or implementing new trade agreements that could alleviate some pressures faced by manufacturers reliant on imported materials.

Conclusion

The antidumping tariffs on aluminum extrusions represent a complex challenge for manufacturers across various industries. While intended to protect domestic producers from unfair competition, these tariffs risk raising costs for manufacturers and consumers alike. As businesses navigate these changes, it will be crucial for them to adapt their strategies while advocating for fair trade practices that support both domestic production and competitive pricing.

FAQs

1. What are antidumping tariffs?

Antidumping tariffs are duties imposed on imports believed to be priced below fair market value, aimed at protecting domestic industries from unfair competition.

2. How do these tariffs impact manufacturing costs?

These tariffs increase material costs for manufacturers who rely on imported aluminum extrusions, leading to higher production expenses that may be passed on to consumers.

3. Which industries are most affected by aluminum extrusion tariffs?

The construction, automotive, aerospace, and consumer goods industries are significantly impacted due to their reliance on aluminum components.

4. What strategies can manufacturers employ to mitigate tariff impacts?

Manufacturers can diversify their supply chains, invest in technology improvements, engage with policymakers for potential tariff relief, and implement cost management strategies.

5. Will these tariffs lead to higher consumer prices?

Yes, increased manufacturing costs due to antidumping tariffs are likely to result in higher prices for products utilizing aluminum extrusions.